Understanding Clone Chip Cards: The Future of Mobile Payments

In the ever-evolving landscape of digital finance, clone chip cards have emerged as pivotal tools that revolutionize how transactions are conducted. With the surge in mobile banking and contactless payments, these innovative cards are not just a trend; they are becoming a cornerstone of modern financial transactions. In this comprehensive article, we will explore everything you need to know about clone chip cards, their functionality, applications, and implications for the future of business and consumer engagement.

What is a Clone Chip Card?

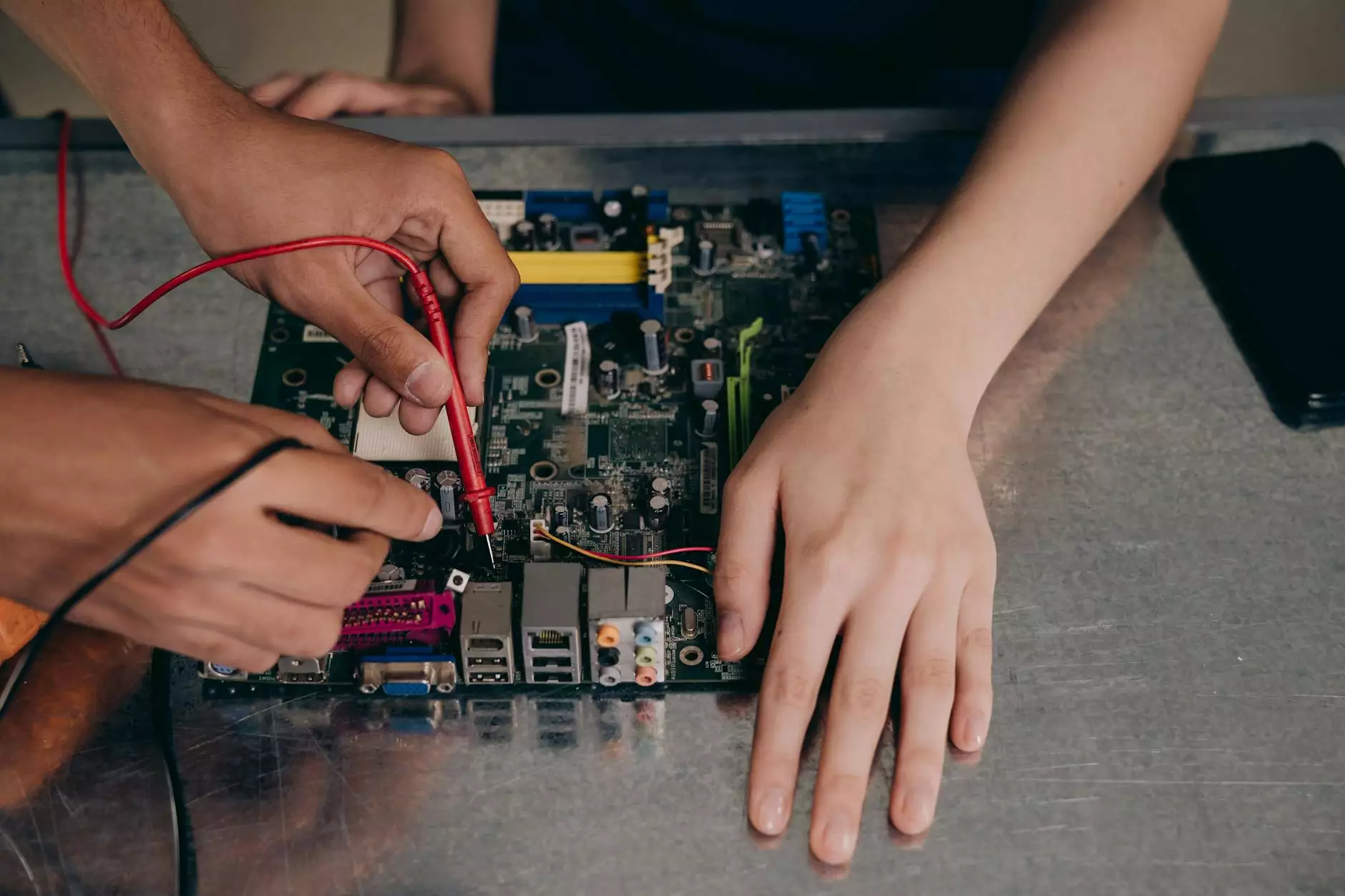

A clone chip card is essentially a smart card that has been duplicated to replicate the functionalities of an original card. Typically, these cards contain embedded microchips that hold encrypted data. This technology allows for secure transactions via contactless methods or traditional chip-and-PIN systems. The cloning process usually involves sophisticated methods and is often surrounded by discussions regarding security and ethical implications.

The Technology Behind Clone Chip Cards

To fully appreciate what clone chip cards offer, it's crucial to understand the underlying technology:

- Microchip Technology: At the heart of every clone chip card is a microchip that functions as both a storage medium and a processor. These chips are programmed to securely store information, including cardholder data and transaction history.

- Encryption: Advanced encryption algorithms protect the data on clone chip cards, ensuring that information is not easily accessible or transferable without the correct authorization.

- Contactless Communication: Many clone chip cards are designed to facilitate NFC (Near Field Communication) transactions, allowing users to make payments by simply tapping their card against a compatible reader.

Uses of Clone Chip Cards in Business

The applications of clone chip cards in the business sector are both diverse and compelling. Here are some of the standout uses:

Enhancing Customer Experience

Businesses using clone chip cards can enhance customer satisfaction by offering quicker, easier, and more secure payment options. This convenience leads to reduced waiting times at checkout and a smoother purchasing process.

Fostering Loyalty Programs

Clone chip cards can be integrated into customer loyalty programs, allowing businesses to track purchasing patterns. Customers can earn rewards points seamlessly, encouraging repeat purchases and strengthening brand loyalty.

Facilitating Expense Management

Many companies issue clone chip cards to employees for expense management. This allows for effortless tracking of spending, simplifies the reimbursement process, and provides valuable insights into corporate expenditures.

Streamlining Transactions for E-commerce

In the realm of e-commerce, clone chip cards enable smooth online transactions. Businesses can offer their customers a robust payment platform that is safe and reliable, attracting more online shoppers.

Security Concerns and Ethical Implications

While the benefits of clone chip cards are significant, it is essential to address the potential security concerns associated with them:

- Fraud Risks: Cloning technology, if misused, can lead to instances of card fraud, affecting both consumers and businesses. It is crucial for companies to implement robust fraud prevention measures.

- Privacy Issues: The extensive data stored on clone chip cards raises privacy concerns, as users often remain unaware of how their information is being utilized.

- Regulatory Compliance: Businesses must ensure that their use of clone chip cards adheres to regulatory requirements to avoid legal pitfalls.

How to Safeguard Against Clone Chip Card Fraud

As with any financial technology, safeguarding against fraud is paramount. Here are some recommendations:

- Use Encryption: Employ strong encryption methods for data storage and during transactions to protect sensitive information.

- Regular Monitoring: Keep an eye on transactions and report any suspicious activity immediately.

- Educate Staff: Training employees on the potential risks and how to handle clone chip cards can bolster security measures.

Future Trends in Clone Chip Card Technology

The landscape of business and financial transactions is constantly evolving, and clone chip cards are at the forefront of this transformation:

- Integration with Mobile Wallets: As mobile wallets gain popularity, expect clone chip cards to seamlessly integrate with these platforms, further enhancing the convenience of digital transactions.

- Enhanced Biometric Security: Future iterations of clone chip cards may incorporate biometric features, such as fingerprint recognition, to add an extra layer of security.

- IoT and Smart Devices: The rise of the Internet of Things (IoT) will likely influence how clone chip cards interact with smart devices, enabling even more innovative payment solutions.

Why Choose Clone Chip Cards? A Final Thought

As businesses look for ways to enhance their payment options and consumer engagement, adopting clone chip cards presents a strategic advantage. The technological sophistication, combined with user-friendly interfaces, makes them an appealing choice for businesses seeking to stay ahead in a competitive landscape. Transitioning to clone chip card solutions not only enhances operational efficiency but also fosters customer loyalty in an increasingly digital world.

Conclusion

In conclusion, clone chip cards represent the future of secure financial transactions. Their ability to streamline processes, enhance customer experiences, and provide valuable data insights cannot be understated. While there are valid concerns on security and ethics, the benefits they offer make them an essential element of modern business strategy. As technology continues to advance, staying informed and adaptable will be key for businesses that wish to leverage the full potential of clone chip cards.